Permit My Rig

Resources for obtaining your permit

How To Get Your Own Trucking Authority?

Ready to hit the road and begin your adventure as a trucking company? We are here to help! If you’re thinking about taking the step of getting your own trucking authority, chances are you’ve been in the trucking industry already and understand that getting your DOT number is not a simple process. Whether you're an accomplished driver or a rookie, we put together a 9 step guide along with some tips gathered from our years of experience to help you along the way.

1. Register Your Company With The Appropriate State or County

Your registration will need to be done based on where your plan to operate. If you are planning on operating as a sole-proprietorship with a DBA, then you’ll need to determine if your state requires you to file your DBA on a state or county level. If you are planning on operating as an LLC or Corporation, you must fill out and submit the correct forms at the Secretary of State’s office, many states will allow you to fill out these forms online.

2. Request an Employer Identification Number (EIN)

If you're a Corporation or an LLC, you must obtain an EIN number which is issued by the IRS. We also recommend individuals operating as a sole proprietor to request an EIN to protect your privacy, as you’ll have to use your social security number in the absence of an EIN.

3. Register Your Trucking Business With The US Department of Transportation (USDOT)

All new trucking companies must register for a USDOT number. Because your USDOT number will provide access to your companies vehicle(s), cargo, safety and compliance information, you’ll need to be prepared to answer a few questions about your new trucking company. All of the information you provide will be filed under your USDOT number and will be available to any shippers you haul for.

4. Apply for your Motor Carrier Number (MC#) with the FMCSA

Your MC# gives you the authority to participate in Interstate Commerce, but that doesn’t mean you can start your route right away. To apply, you’ll need all of the information you gathered for your USDOT registration. After receiving your MC#, you’ll have just 20 days to complete the next two steps. Once the two items are on file with the FMCSA, your authority will become active in 2-3 weeks.

5. File a BOC-3

The FMCSA requires a designated process agent that can be served legal paperwork on your company's behalf, if the need arises.

6. Obtain Trucking Insurance

You must have a minimum $750,000 Liability Insurance – Click here for a fast free quote! Not sold? Here are 10 Reasons To Choose Insure My Rig - The Leader In Trucking Insurance.

7. Get the apportioned plates and set up your International Registration Plan (IRP)

The IRP is the process of registering vehicle fleets traveling in two or more member jurisdictions. If you operate a truck in multiple jurisdictions, you’ll need to annually report the mileage driven in each state and pay the taxes on your mileage driven. To set up your IRP plan, you’ll need your trucks vin number, title information, purchase cost and make, model, etc. You’ll also need an idea of what states you are planning to haul in. Once you submit your registration, the DMV will let you know your fee. Once paid, you’ll receive your apportioned tags.

8. Set up an International Fuel Tax Agreement (IFTA) Account

The IFTA is an agreement to help simplify the reporting of fuel used by motor carriers that operate in more than one jurisdiction. IFTA carriers will receive an IFTA license and two decals for each qualifying vehicle. At the end of each fiscal quarter, you are required to complete your fuel tax report.

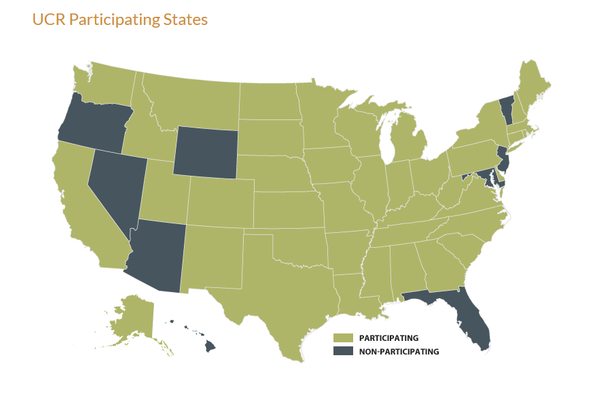

9. Registering with the The Unified Carrier Registration (UCR)

The UCR program requires individuals and companies operating commercial motor vehicles in interstate or international commerce to register their business in their base state and pay an annual fee based on the size of their fleet.

Still confused on how to get your trucking authority?

Bellow we have gone a little deeper in explaining how to get your permit

Why do I need my own Authority?

If you think there is too much government regulation of getting your trucking, authority, you are undoubtedly correct. However, it was once worse. Click here to read more about the History of Government Regulation of Trucking

What is the UCR Program?

- The Unified Carrier Registration (UCR) Program is a federally-mandated, annual state-administered registration program. Motor carriers, motor private carriers, freight forwarders, leasing companies and brokers based in the United States, Canada, Mexico, or any other country that operate in interstate in interstate or international commerce in the United States must register under the UCR program.

- The UCR Program is similar to the SSRS in that UCR is a Base-State system, under which a carrier pays UCR fees through its Base Sate on behalf of all participating states.

- Entities not required to register under the UCR program include:

- 1) USDOT registrants (usually owner-operators that do not have interstate authority) under the PRISM program

- 2) Purely intrastate carriers, that is, those that do not transport interstate freight or cross state lines.

What Is A DOT Number, And Do I Need To Have A DOT Number?

The USDOT Number serves as an identifying number for officials when collecting and monitoring a company’s safety information acquired during audits, compliance reviews, interventions, crash investigations, and inspections.

A USDOT Number is required if you have:

- If you transport between 9 and 15 passengers (including the driver) for compensation,

- If you transport 16 or more passengers, or

- Haul hazardous materials in interstate commerce.

- Vehicles that are over 10,000 lbs

What all is required for having your own Authority?

US DOT Number

EIN Number

BOC-3 Form Filed

UCR Registration

Motor Carrier Number

Apportioned license plate

IFTA License and Decal Stickers

- Minimum $750,000 Liability Insurance

*GVWR of 26,000 and over

Safety Audit Information for new entrants:

All new entrants will be required to have a DOT Safety Audit usually within the first 3-6 months of activation, and you’ll be notified of this by U.S. mail. After being notified, you have 90 days to schedule your audit with the DOT. Usually a state police officer will conduct the audit at your place of business. Some of the important items to have on file are listed below:

Pre-employment drug test for all drivers

DOT Medical examination. A medical card will be issued and is good for 2 years

Enrollment in a drug-testing program

Daily vehicle inspection sheets

DOT Certified annual inspection of equipment

Company Drug and Alcohol Policy

Supervisor Training Program. (This is required if you have more than one driver). If you would like to take this DOT certified online training please e-mail us at shawn@sasafetyservices.com

MCS-90 proof of financial responsibility (provided by your insurance carrier)

*(If you would like assistance with your DOT Safety Audit, please e-mail S.A. Safety Services, LLC at shawn@sasafetyservices.com)

How Do I Figure Out My GVWR To Report?

The GVWR is your Gross Vehicle Weight Rating and it is the maximum total weight of the truck or truck and trailer combined fully loaded.

My Application Is Filed And I Have My US DOT And MC #’S. Can I Begin Operating?

Not until your authority becomes active. If you are stopped by a DOT officer, and your authority is not active, he can place you out of service and fine you $1,000 to $10,000. You also need insurance in place, click here for a free quote!

What are the Exempt Commodities?

Please visit fmcsa.dot.gov for complete list.

What Is The Definition Of An Authorized For-Hire Carrier?

An authorized for-hire carrier is a person or company that engages in the transportation of cargo or passengers for compensation.

Will I Need Anything Else To Travel In The 48 States?

There are 4 states that have their own weight distance tax permits. They are Kentucky, New Mexico, New York, and Oregon. If you travel through any of these states you are required to either have a temporary or permanent permit. In most cases, the permanent permit will be the less expensive in the long run.

How Long Does The Process Of Getting My Authority Take?

It can take about 20 days to get your permit, providing your insurance and process agents are on file with the FMCSA. Some carriers will need to have their Single State Registration before they can start trucking, which can take a couple of weeks.

What Is The BOC-3 Form?

We file the BOC-3 form with the FMCSA in order to designate a process agent for you in all 50 states. A process agent is a representative upon whom court papers may be served in any proceeding brought against a motor carrier, broker, or freight forwarder.

What Is The Definition Of An Authorized For-Hire Carrier?

An authorized for-hire carrier is a person or company that engages in the transportation of cargo or passengers for compensation.

What Is The Difference Between Interstate Carriers And Intrastate Carriers?

Interstate carriers carry cargo across state lines, while intrastate carriers operate within a single state.

How do I get my active broker authority?

First, Complete and file the Broker Authority Application. Then, a property broker must have a surety bond or trust fund in effect for $10,000. The FMCSA will not issue a proper broker license until surety bond or trust fund for the full limits of liability prescribed herein is in effect. The broker license shall remain valid or effect only as long as the surety bond or trust fund remains in effect and shall ensure the financial responsibility of the broker.

A household goods broker must have a surety bond or trust fund in effect for $75,000 on and after January 1, 2012. The FMCSA will not issue a household goods broker license until surety bond or trust fund for the full limits of liability prescribed herein is in effect. The household goods broker license remains valid or effective on as long as a surety bond or trust fund remains in effect and ensures the financial responsibility of the household goods broker. Evidence of a surety bond must be filed using the FMCSA’s prescribed Form BMC 84. Evidence of a trust fund with a financial institution must be filed using the FMCSA’s prescribed Form BMC 85. The surety bond or the trust fund shall ensure the financial responsibility of the broker by providing payments to shippers or motor carriers if the broker fails to carry out its contracts, agreements, or arrangements for the supply of transportation by authorized motor carriers.

What Is IFTA (International Fuel Tax Agreement) And The Requirements?

IFTA Fuel Tax Reporting is required for any vehicle crossing state lines with GVW/GVWR over 26,001 lbs. The IFTA agreement states that you pay the taxes the state charges at the pump on any mileage run in that state even if you did not purchase fuel there.

- Under the IFTA, you are issued an IFTA license and one set of IFTA decals per truck, which will allow you to operate in all other IFTA jurisdictions without buying additional decals from those jurisdictions.